Warning required before crime

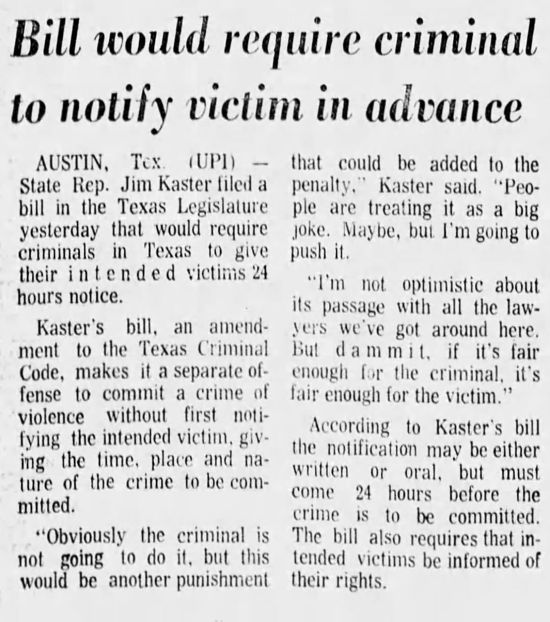

January 1973: Texas State Rep. Jim Kaster filed a bill that would have required criminals to give their victims twenty-four hours notice before they committed a crime. Argued Kaster, "Obviously the criminal is not going to do it, but this would be another punishment that could be added to the penalty." No surprise, the bill was defeated.

And this article gives a little more info:

Arizona Republic - Jan 19, 1973

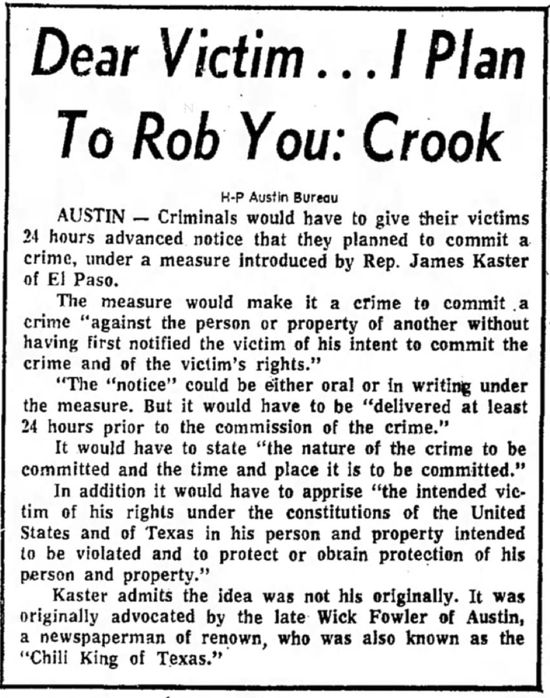

And this article gives a little more info:

El Paso Herald-Post - Jan 19, 1973

Comments

Trash-talking via the postal service. I'm guessing you'd have to send the letter anonymously. And then, to make sure you 'got away with it', not perform the actual crime until several weeks have passed, making the victim guess it was 'all just a joke'.

If I did such a thing.

If I did such a thing.

Posted by Greg on 06/11/16 at 08:57 AM

This kind of "thinking" is what has gotten us where we're at today. I've heard that NY has, already, started a tax on vapor cigarettes! No excuse, just a tax revenue to replace the one they lost on tobacco. And, We The People, are getting baaaaaad at following these jerks off the cliff.

Posted by Expat47 in Athens, Greece on 06/11/16 at 09:21 AM

So that's why we see so much movies with little notes left by criminals, saying "Tomorrow, your diamonds will be mine, mwa-ha-ha-ha!" or something of the sort.

Posted by Yudith on 06/11/16 at 10:12 AM

I wonder if the proposed bill said the notice had to be in English.

Could you deliver it orally by hiring a street performer to rap it as the intended victim passes by?

Maybe criminals could make a little money on the side by sending advertisements for phone service with their required notice in fine print at the bottom.

So many loopholes . . .

Could you deliver it orally by hiring a street performer to rap it as the intended victim passes by?

Maybe criminals could make a little money on the side by sending advertisements for phone service with their required notice in fine print at the bottom.

So many loopholes . . .

Posted by Phideaux on 06/11/16 at 11:29 AM

i've got it! let's tax illegal drugs! that way, people arrested for illegal drug distribution or possession can also be charged with tax evasion!

what's that? it's already been done in texas? oh well

what's that? it's already been done in texas? oh well

Posted by dave on 06/11/16 at 03:27 PM

@Dave -- Almost every state I've lived in has sold marijuana tax stamps even though marijuana is illegal. Not only is it an opportunity to pile on more charges, it actually produces income for the states because there are collectors who buy all kinds of tax stamps.

Posted by Phideaux on 06/11/16 at 03:54 PM

Yet another idiot who believes that heavier punishment means less crime. Almost every study ever done shows that it's not the severity, but the likelihood and promptness of being punished, that deters crime. But that would mean the police and judiciary actually doing their jobs and making an effort, rather than just taking the sound-bitable, reactionary-public-stroking easy way out - and we can't have that, can we, Trump-voters?

Posted by Richard Bos on 06/11/16 at 05:55 PM

Well, Rich, once again we're on opposite sides (almost). I agree that 'getting caught' is a big factor but I'll guarantee that a speedy (within weeks) trial and a rope at the end would be a BIG determent to crime.

Posted by Expat47 in Athens, Greece on 06/11/16 at 06:48 PM

Great finds, Alex. We laugh and think, boy the 70s were full of strange ideas. But... something like this already happened already in 1970. And it is still law today.

Congress passed the Bank Secrecy Act of 1970 that required criminals to alert law enforcement where their illegally money may be offshore. No one thought for second that criminals would comply but the failure to report the funds lead to the possibility of huge civil and criminal penalties. Like Rep. Kaster "Obviously the criminal is not going to do it, but it could be another penalty added to the punishment."

The form is called a Report of Foreign Bank Accounts, yet somehow they get the acronym "FBAR" out of it. It is now officially named IRS Form 114 (No longer Form TD F 90.22-1 because reasons) . Because that's right, even though the form has nothing to do with tax compliance the IRS is in charge of processing the forms and assessing penalties.

And of course, the people most penalized? Criminals? No. Innocent or at perhaps negligent taxpayers who missed this form and are facing the full wight of the IRS. These people are my clients. They tend to be expats, people who inherited money overseas, visa holders, dual citizens, some of the best people on the earth. Who are assumed to be criminals by the US government.

Unfortunately the FBAR terror only affects a small percentage of the population and most people aren't going to care.

I wrote more about this dismal failures that is the Bank Secrecy of of 1970 here: https://www.irsmedic.com/2014/11/08/failure-bank-secrecy-act/

Congress passed the Bank Secrecy Act of 1970 that required criminals to alert law enforcement where their illegally money may be offshore. No one thought for second that criminals would comply but the failure to report the funds lead to the possibility of huge civil and criminal penalties. Like Rep. Kaster "Obviously the criminal is not going to do it, but it could be another penalty added to the punishment."

The form is called a Report of Foreign Bank Accounts, yet somehow they get the acronym "FBAR" out of it. It is now officially named IRS Form 114 (No longer Form TD F 90.22-1 because reasons) . Because that's right, even though the form has nothing to do with tax compliance the IRS is in charge of processing the forms and assessing penalties.

And of course, the people most penalized? Criminals? No. Innocent or at perhaps negligent taxpayers who missed this form and are facing the full wight of the IRS. These people are my clients. They tend to be expats, people who inherited money overseas, visa holders, dual citizens, some of the best people on the earth. Who are assumed to be criminals by the US government.

Unfortunately the FBAR terror only affects a small percentage of the population and most people aren't going to care.

I wrote more about this dismal failures that is the Bank Secrecy of of 1970 here: https://www.irsmedic.com/2014/11/08/failure-bank-secrecy-act/

Posted by Anthony E. Parent on 06/12/16 at 09:02 AM

"And of course, the people most penalized? Criminals? No. Innocent or at perhaps negligent taxpayers who missed this form and are facing the full wight of the IRS."

It's one of the many, many entrapment laws on the books for no other reason than to increase revenue from the middle class. There's a big push on now for all of us expats to report any funds we have in foreign banks.

The noose is tightening around the necks of "We the People".

It's one of the many, many entrapment laws on the books for no other reason than to increase revenue from the middle class. There's a big push on now for all of us expats to report any funds we have in foreign banks.

The noose is tightening around the necks of "We the People".

Posted by Expat47 in Athens, Greece on 06/12/16 at 09:10 AM

Commenting is not available in this channel entry.

Category: Crime | Law | 1970s